Assessing

| Contact: | Elizabeth Labbe - Assessing Clerk |

| Address: | 5 East Main Street PO Box 265 Warner NH 03278 |

| Phone: | 603-456-2298 x3 |

| Email: | assessing@WarnerNH.gov |

| Hours: | 9:00 AM to 4:00 PM Mon 9:00 AM to 6:00 PM Tue 9:00 AM to 4:00 PM Wed 7:00 AM to 7:00 PM Thu |

Property Taxes

If you are behind, consider applying to NH's Homeowners Assistance Fund. It must be done online - I can help if needed.

Revaluation Notes

Revaluations are done every five years. Our cycle is on years divisible by 5. During years in which a revaluation is done, the first issue property tax bill of that year will not reflect the new assessment values. Unless you have made changes to your property the first bill in the revaluation year will be one half of the total bill for the prior year. This first bill is defined as an estimated prepayment. The new values will be used to compute the new tax rate in the fall. Then it will be new value times new rate for the second bill of the revaluation year.

2025 Revaluation Values - 04/01/25

Tax Credits & Exemptions:

- Veteran's Tax Credits:

- Standard Tax Credit: $500 (RSA 72:28)

- Surviving Spouse: $700 (RSA 72:29-a)

- Disabled Veteran: $1,400 (RSA 72:35)

- Other Exemptions:

- Exemption for the Blind (RSA 72:37)

- Elderly Exemption: (RSA 72:39-a)

- Solar Energy System (RSA 72:27-a, RSA 72:61, RSA 72:62)

- Wind Powered Energy System (RSA 72:27-a, RSA 72:65, RSA 72:66)

- NH Department of Revenue Administration Exemption and Tax Forms

Filtering by group: Assessing

| Assessing | |||||

| Application | |||||

| Discretionary Preservation Easement | |||||

| Elderly Exemption Worksheet | |||||

| Restoration of Merged Lots | |||||

| Solar Worksheet | |||||

Additional Information and Links:

- Abatements and Exemptions Form

- Application for Building Permit

- Application for Driveway Permit

- Application for Restoration of Involuntarily Merged Lots

- Assessing Process FAQ

- Change of Address Form

- Contracted Assessor: Avitar Associates

- Cutting Trees

- Intents-to-Cut (RSA 79:10)

- NH Board of Tax and Land Appeals

- 2025 Revaluation: Timeline

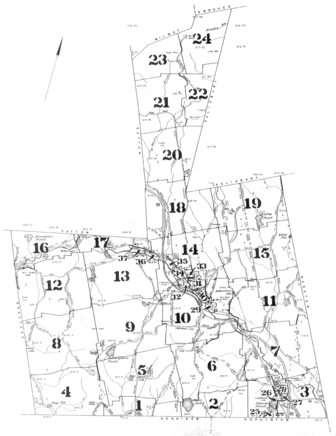

- Tax Maps

- Zoning Map

Cutting Trees

I want to have some trees cut in my backyard; do I need to notify the Town?

Most timbering operations require a Notice of Intent to Cut to be filed with the Town. Timber on all land ownerships is taxable at 10% of the stumpage value at the time of cutting. The only timber harvesting which does not require a Notice of Intent to Cut to be submitted and is exempt from the timber tax, is as follows:

- 10,000 board feet of saw logs and 20 cords fuel wood for personal use by the owner. (RSA 79:1 II(b) 1 & 2)

- 10,000 board feet of saw logs and 20 cords of wood for land conversion purposes, when all permits for the conversion have been received.(RSA 79:1 II (b) 5)

- Shade and ornamental trees, usually considered to be trees within striking distance of a building. (RSA 79:2)

- Christmas trees, fruit trees, and nursery stock and short rotation tree fiber. (RSA 79:2)

- Any amount of firewood for maple syrup production. (RSA 79:1 II (b) 2) 6. Government and utilities not selling the wood. (RSA 79:1 II (b) 3 & 4)

If you or your logger are planning a timbering operation which is not covered by the above exemptions, even if you do not receive any money from the project, you are required to file a Notice of Intent to Cut with the Town. The Notice of Intent to Cut must be completed with a volume estimate, signed by the assessing officials and posted on the job site before any cutting which requires a Notice can start. Since many departments review the paperwork, you should file at least a month before you wish to start the timber harvesting. Additional information can be found on the NH Division of Forest and Lands website.